George Tafaria Waititu is the founder of Tafaria Castle, a medieval-style resort and country lodge built on a hill overlooking the Aberdare Range, Laikipia Plains and Mount Kenya.

George Tafaria Waititu is the founder of Tafaria Castle, a medieval-style resort and country lodge built on a hill overlooking the Aberdare Range, Laikipia Plains and Mount Kenya.

Before setting up the Castle in 2012, Waititu was at the height of his career as the face and Managing Director of Steadman Group (now Ipsos Synovate).

More recently, the entrepreneur was the brains behind ViuSasa, a video on demand platform. He shared with Hustle the lessons his entrepreneurial journey has taught him.

Where were you at age 25?

At 25, I had a young family, was already in employment in a managerial capacity. I am driven by passion in pursuit of own and very personal goals – in that regard, I would say I am to a large extent ambitious.

Did you find freedom in entrepreneurship?

Freedom in business is a plain lie, at least for me I haven’t seen that. No one is free. Your commitments, whether you work for yourself or not, is what enslaves you. Remember that your business does not know that you own it and it makes demands on you all the time. So if you are stepping out to set up a business in search of freedom, you are mistaken. Instead, do it for the love of it – and as much as possible try to fit it to your lifestyle, and you will never experience a moment of enslavement.

Did you for one minute have doubts about quitting your high flying job at Ipsos Synovate?

I wasn’t at all afraid. I am glad I quit when I did because if I hadn’t, my childhood dream would have gone unrealised. That said, employment taught me a lot of things I use in business. I learnt some marketing strategies, business finance, use of research for business, human resource management and general operations of a business. I don’t regret quitting though. I would still do it again. But I had to do a few things to transition from employment to self-employment.

Things such as?

To leave my job, I had to have a dream at hand, have figured out how to realise it, worked the small steps, have aligned resources to these steps and eventually forsook all else. That includes the status, friends and perks brought on by employment. When all that was done, I could boldly get out and pursue my plan with brutal consistency. If you want to get out of employment and get into the business, I say, JUST DO IT.

How did you raise the capital?

It was a basket: Income wage, savings, capital gains and bank loans. Each source type kicked in at different stages of building it. About loans and small businesses, I would say that we operate in a very imperfect market and sometimes things go south even when you had borrowed smartly with the best of intentions. I, however, believe in borrowing only for transformative business goals. This means that I only borrow for those goals that have the ability to accelerate cash generation and not necessarily asset enhancement.

How long was it between envisioning the idea of Tafaria and making the first step towards making it a reality?

It took many years, and when I hit my 30s, I took very deliberate steps towards the realisation of this long-held dream. Since I was deeply in love with the idea, I did not have doubts in its success and was able to circumvent the various challenges that arose along the way. You are very likely to fail if you are pursuing a strategy of envy, but if the idea is original and you are passionately invested, chances of success are higher – but of course, there are very many factors that contribute to success or lack of it.

Having been the face of research back at Synovate, is research into the market something that has aided your success in your business journey?

Research became a passion and an obsession of mine – hence the introduction of opinion polling and the research clubs of Kenya to help demystify and mainstream research. I apply it a lot. Having used it to guide many businesses and organisations over the years, I am an avid user of research on mine. Having said that, to start Tafaria did not require much research but more of creativity and innovation, that is, what kind of a project do you establish to sustainably bring about social infrastructure to a village, create jobs, bring about rural social prestige, make that which had no value highly valuable? Most of the thinking went into that.

What is the biggest challenge you have faced doing business in Kenya?

The lack of facilitative infrastructure by the government – we had to invest (we still do) a large portion of the investment on infrastructure like roads, water and power. Second one is finding relevantly qualified labour – we still retrain graduates – I have a lot to say about this.

Being in your 40s now, how have you planned for your retirement?

I like to think that retirement is a mirage. It’s extremely hard to stop working and move into nothing. My view is that we retire from one thing to another. I retired from research at 37 and started on other things; largely fashioned around my lifestyle. I would love if old age found me at the Tafaria Museum & Centre for the arts providing the creative communities with enablers of success and using it to advance social change. My advice to anyone planning retirement is let your life in ‘retirement’ be around what you love doing.

How has the pandemic affected your business?

It has been very painful. We closed for six months! You can imagine the pain on our staff, suppliers and business loss. We got back in play in August and I am glad we have sustenance.

What insights have you gained since the operations began that you think someone getting into the same field should know?

Stick to what you love. That makes all the difference. Do not copy others as the journey will become painful. You must NOT be a social conformist.

As an employer, what counts more to you; experience or academic papers?

Both count a lot. But what matters more is the ability to execute regardless of how the skills were acquired. I find those with hands-on experience being better performers than those with only papers. I am very passionate about apprenticeship to an extent that we run a formal apprenticeship programme at Tafaria.

What are the main things you put into consideration when sinking your money into an investment?

Like most investors, the areas with the most return. However, mine is mainly driven by what maximises joy in execution – the journey to me is usually more important. I must enjoy it as the end result is always a mirage. But I have made some bad investments; more than I care to count and I consider them as the cost of research. That said, I tend to fashion my investments around my lifestyle such that even if they don’t work out, I will have enjoyed the journey nevertheless.

How do you feed your mind daily to stay sharp?

I am a lover of applied arts and the Tafaria Centre for the Arts keeps my heart delighted, well-fed mentally and above all, intellectually nourished – I can’t dream of better. Continuous learning is inevitable – deliberate or not. The passage of time alone brings learning with it, you just have to harness and apply. My advice to anyone is to seek relevant learning – lots of us tend to accumulate a lot of academic qualifications that are of little value to what the business demands now and in the future.

source

http://nairobiwire.com/2020/12/from-steadman-group-md-to-owning-tafaria-castle-meet-george-waititu.html

For many years, in most African countries, various social tendencies remained practically unchanged due to strong traditionalist sentiments compared to Europe and the United States. Until recently, Kenya remained among the African territories with minimal statistical data discrepancies regarding its citizens’ marital status.

For many years, in most African countries, various social tendencies remained practically unchanged due to strong traditionalist sentiments compared to Europe and the United States. Until recently, Kenya remained among the African territories with minimal statistical data discrepancies regarding its citizens’ marital status.

It appears someone at IEBC social media department was honest today. Perhaps a little too honest.

It appears someone at IEBC social media department was honest today. Perhaps a little too honest.

George Tafaria Waititu is the founder of Tafaria Castle, a medieval-style resort and country lodge built on a hill overlooking the Aberdare Range, Laikipia Plains and Mount Kenya.

George Tafaria Waititu is the founder of Tafaria Castle, a medieval-style resort and country lodge built on a hill overlooking the Aberdare Range, Laikipia Plains and Mount Kenya.

A routine question from her doctor about menstruation set Julian Peter, 29, down a path that led her to discover she was born without a womb or a vagina, a rare condition called Mayer-Rokitansky-Küster-Hauser (MRKH).

A routine question from her doctor about menstruation set Julian Peter, 29, down a path that led her to discover she was born without a womb or a vagina, a rare condition called Mayer-Rokitansky-Küster-Hauser (MRKH).

Carol Kariuki was a corporate banker who led the Savings & Loan Division when it was a subsidiary of Kenya Commercial Bank.

Carol Kariuki was a corporate banker who led the Savings & Loan Division when it was a subsidiary of Kenya Commercial Bank.

Rachael Watiri graduated in 2015 eager to start her nursing career. While waiting to get a placement, Watiri started an online clothing store.

Rachael Watiri graduated in 2015 eager to start her nursing career. While waiting to get a placement, Watiri started an online clothing store. Erastus Mbuno is a cancer specialist and a front-line health officer in the fight against Covid-19 at Kitui County Referral Hospital. His father succumbed to Thyroid cancer, which shaped Mbuno’s passion in medicine.

Erastus Mbuno is a cancer specialist and a front-line health officer in the fight against Covid-19 at Kitui County Referral Hospital. His father succumbed to Thyroid cancer, which shaped Mbuno’s passion in medicine. Fred Kithinzi an internet-prenuer, a marketer, an Afrocapitalist, founder and CEO of Belva Digital, an award-winning digital marketing agency.

Fred Kithinzi an internet-prenuer, a marketer, an Afrocapitalist, founder and CEO of Belva Digital, an award-winning digital marketing agency. Anne Mugo is the co-founder of The Farm Gang, an agribusiness firm that specialises in the organic growth of strawberry fruits, seedlings, and farming training.

Anne Mugo is the co-founder of The Farm Gang, an agribusiness firm that specialises in the organic growth of strawberry fruits, seedlings, and farming training. Sylvia Bonareri is the founder of Azuri Closet, an online boutique that stocks ladies’ wear and accessories. The lawyer spoke to People Daily about style and fashion.

Sylvia Bonareri is the founder of Azuri Closet, an online boutique that stocks ladies’ wear and accessories. The lawyer spoke to People Daily about style and fashion.

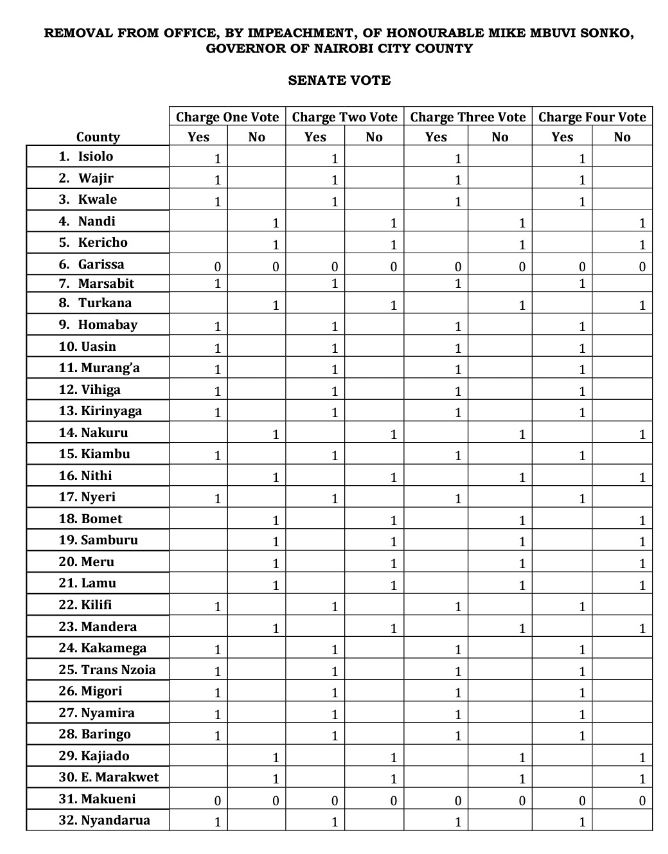

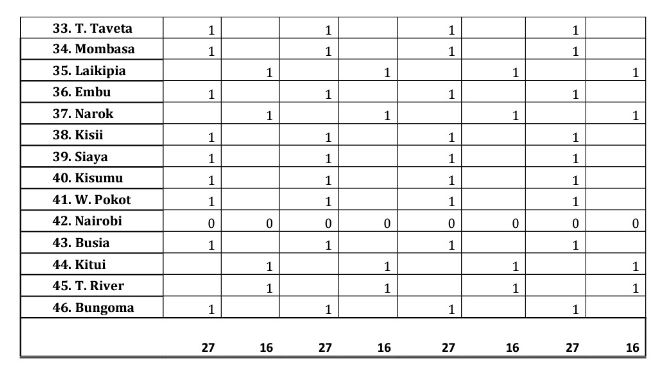

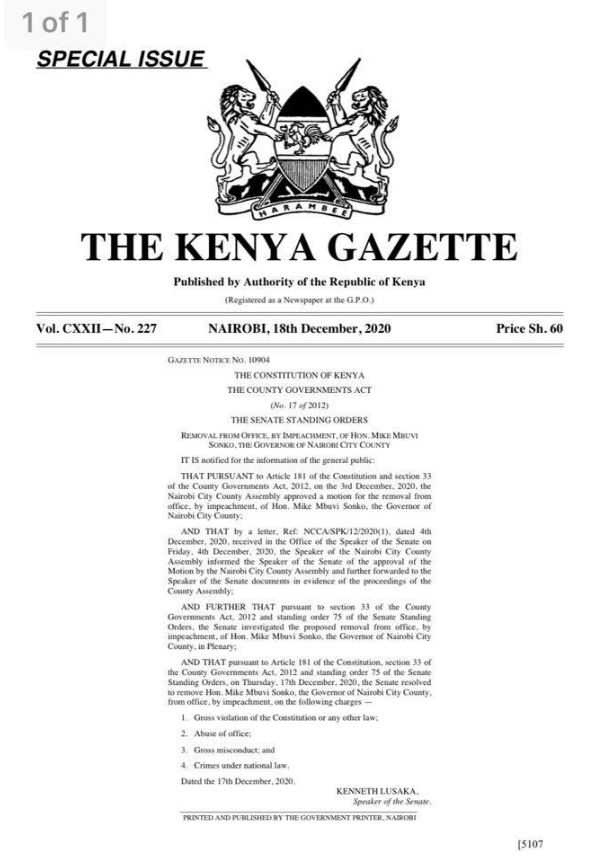

Nairobi Governor Mike Mbuvi Sonko on Thursday night became only the second governor to be impeached and removed from office.

Nairobi Governor Mike Mbuvi Sonko on Thursday night became only the second governor to be impeached and removed from office.

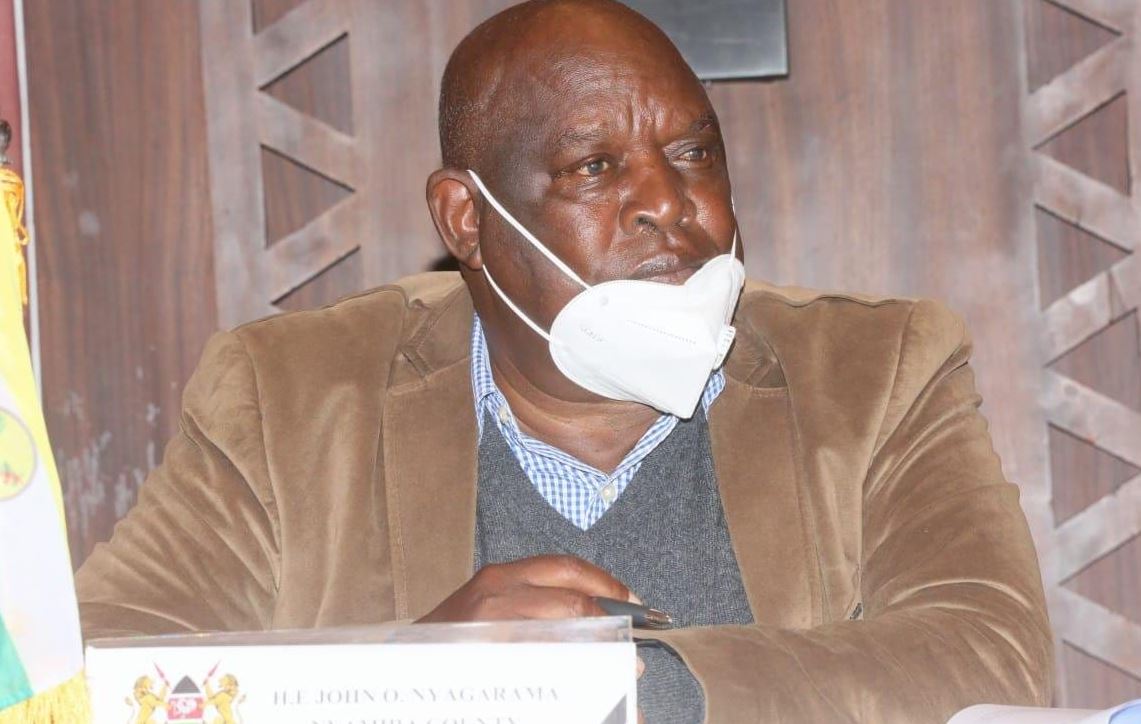

Nyamira Governor John Nyagarama died Friday morning, becoming the latest high profile Kenyan to succumb to Covid complications.

Nyamira Governor John Nyagarama died Friday morning, becoming the latest high profile Kenyan to succumb to Covid complications.

President Uhuru Kenyatta has inaugurated the National Air Support Department (NASD), a multi-agency unit within the Ministry of Defence charged with the responsibility of coordinating Kenya’s national air response services.

President Uhuru Kenyatta has inaugurated the National Air Support Department (NASD), a multi-agency unit within the Ministry of Defence charged with the responsibility of coordinating Kenya’s national air response services.